Application Programming Interface or API serves as a data connection that facilitates the sharing of data with other applications. In today's rapidly evolving digital landscape, Application Programming Interfaces (APIs) are pivotal in connecting various software applications, enabling seamless data exchange, and powering countless online services.

While APIs offer unparalleled efficiency and flexibility, they also introduce a significant security challenge. The importance of securing APIs cannot be overstated, as they serve as gateways to your digital assets and sensitive information.

APIs can simplify app development and integration of multiple product functionalities, saving time and money while providing a seamless user experience. While designing new tools and products, APIs provide flexibility, ease of usage and they play a central role in both mobile commerce and the Internet of Things (IoT).

Usage of APIs has increased significantly in the past few years. Akamai estimates that roughly 83% of internet traffic is being driven by APIs. Further, according to the Slashdata survey, which offers several granular insights into how developers use APIs, nearly 90% of developers are using APIs in some capacity.

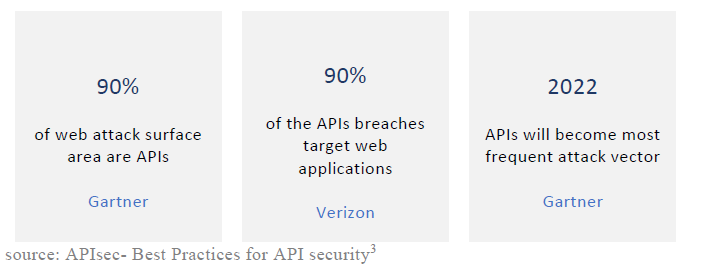

With an exponential growth in the number of API calls, there is an aggressive increase in abuse of these APIs. Gartner predicts that 90% of web-enabled applications will have broader attack surfaces due to exposed APIs. The latest study from Imperva claims that vulnerable APIs are costing organizations between $40 and $70 billion annually.

Due to their direct access to extremely sensitive data and functionality, APIs are frequently cited as one of the primary security concerns that organizations face. APIs are changing the landscape of financial services and playing a critical role in the rise of Fintech and Open Banking. banks are in a position to provide better customer experience and develop new revenue streams by relying on banking APIs. APIs have opened doors to technologies such as P2P payments and cryptocurrency exchanges. However, with this rise of digitization and API usage in the financial sector along with the availability of sensitive customer information, the financial industry is also becoming a preferred target for API attacks. Indian Financial Sector since 2021 has observed a consistent rise in API attacks.

The most common API attacks can be listed as follows:

With the exponential growth in API usage, there has been a corresponding rise in API abuse. The transition from monolithic architectures to cloud-based microservices and containers has brought about a paradigm shift in development cycles but has also expanded the surface area of vulnerabilities exposed to the internet.

In the present day, APIs grant access to functionalities that were once confined within monolithic structures, resulting in a greater number of potential vulnerabilities to exploit. Additionally, the proliferation of endpoints available for interaction has amplified the attack surface. By following best practices for web application security and API security, you can significantly reduce the risk of attacks and enhance the overall security of your systems.