The Reserve Bank of India (RBI) announced the launch of the first pilot for retail digital Rupee (e₹-R) on December 01, 2022. It has commenced the pilot in the wholesale segment from November 2022.

The Central Bank Digital Currency (CBDC) can be defined as the legal tender issued by the Reserve Bank of India, according to the RBI. Touted as Digital Rupee or e-Rupee, RBI's CBDC is the same as a sovereign currency and is exchangeable one-to-one at par with the fiat currency, the regulator mentioned

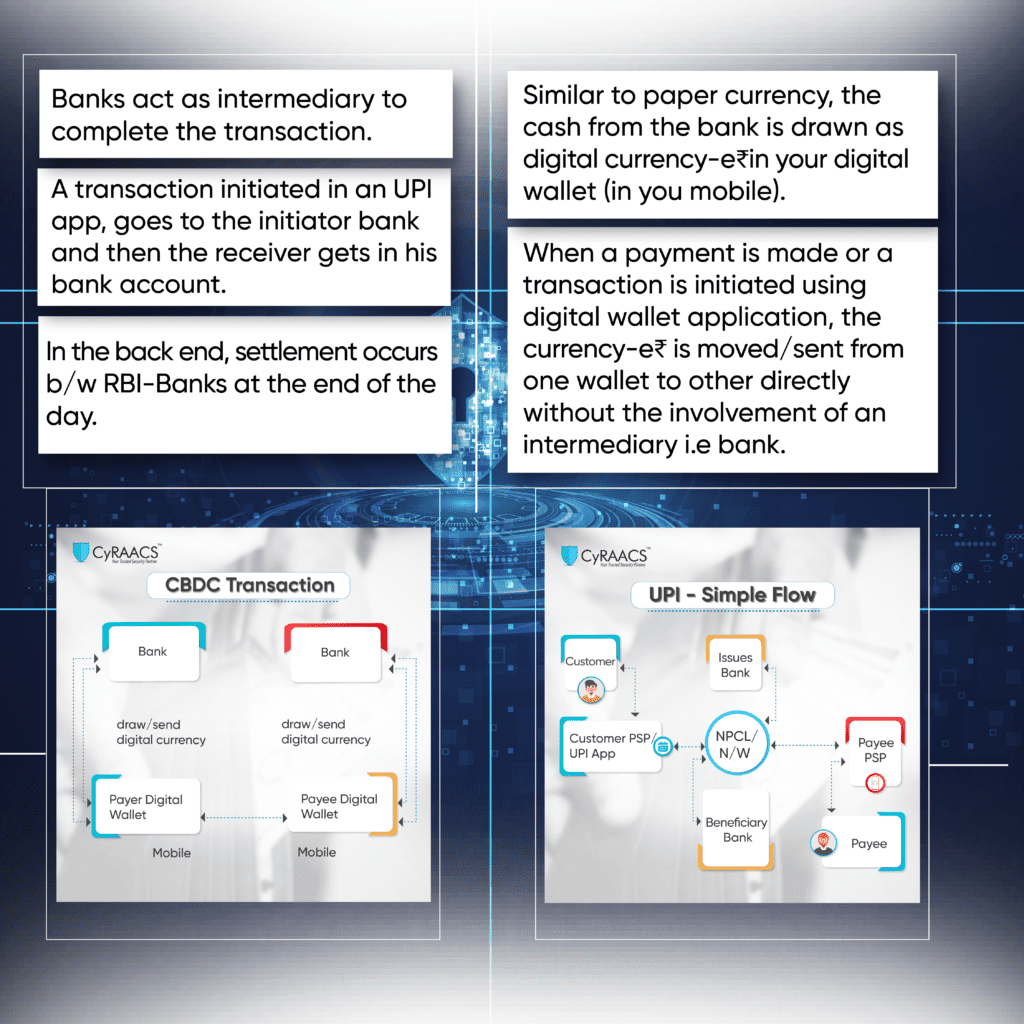

As we learn more on how the digital wallet application will function in the retail segment, how users can load/redeem digital rupee and how a transaction b/w two devices happen, it looks like this will play parallel to UPI and Wallets.

However, I wouldn’t be surprised if the e₹ digital wallet kill UPI and PPI Wallets in the longer run. Not sure about UPI but definitely it’s going to impact the Wallet instruments like PPI in the long run. Question is ‘Will wallet companies start providing digital wallet using CBDC’ or ‘Why should someone use a wallet when Digital Wallet with e₹ and UPI exist.

Not sure if offline payments can happen directly b/w mobile phones for e-rupee transaction. Logically looks like it’s viable. NFC/Bluetooth communication between two devices should work.

Few questions that arise for the future:

1. Banks have been burning cash for building UPI services and not getting much in returns. Will e₹ application change the scene?

2. Can pre-paid wallets continue to have relevance over the digital e₹ wallet.

3. Privacy concerns have already been raised. Will transactions be private and the role of tech here?

4. The multiple and most futuristic use cases that can be developed and operated with CBDC?

As an IS auditor for financial institutions, will research and post on regulatory requirements, how the application works to controls that matter the most in having this implemented and integrated in the system, and risk factors to keep mind for CBDC in Digital Payment Security.

Overall, Digitalization in payments and banking is continuing to reach new heights and India is setting an example to the world!

We are a CERT-IN Empanelled cyber security company based out of Bangalore. Reach out to us to gain more insights into the Digital Payment Security Domain and for a free consultation!!!